UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| Check the appropriate box: | ||

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

COUPANG, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check all boxes that apply): | ||

| ☒ | No fee | |

| ☐ | Fee paid previously with preliminary | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |

2024

Proxy Statement

And Notice of Annual Meeting

of Stockholders

| 2024 Coupang Proxy Statement |

PROXY STATEMENT

For the 2024 Annual Meeting of Stockholders

To Be Held on Thursday, June 13, 2024 at 5:00 p.m., Pacific Time

|  |  |

TIME 5:00 p.m. Pacific Time | DATE June 13, 2024 | LOCATION Virtual www.virtualshareholdermeeting.com/CPNG2024 |

720 Olive Way, Suite 600

Seattle, Washington 98101

| Proposals | Coupang, Inc. (the “Company”, “Coupang”, “we,” or “us”) is holding |

this Proxy Statement (this “Proxy Statement”):

1. | to elect the seven director nominees named |

2. | to ratify the appointment of Samil PricewaterhouseCoopers as our independent registered public accounting firm for the fiscal year ending December 31, |

3. | to consider a non-binding vote to approve the compensation of our named executive officers (Proposal No. 3); |

and

4. |

| to consider such other business as may properly come before the Annual |

| Record Date | Stockholders of record as of the close of business on April | |

| Proxy Voting | On or about | |

As described in | ||

| Attending the Meeting | To attend the Annual Meeting, vote, or view the list of registered stockholders during the Annual Meeting, stockholders of record will be required to visit the meeting website listed above and log in using their 16-digit control number included on their proxy card or Internet Notice. Beneficial owners should review the proxy materials and their voting instruction form or Internet Notice for how to vote in advance of, and how to participate in, the Annual Meeting. |

By Order of the Board of Directors, | |||

| Harold Rogers | |||

| General Counsel and | |||

| Chief Administrative Officer |

1 | 2024 Coupang |

| Proxy Statement |

TABLE OF CONTENTS

| PROXY STATEMENT | 3 |

| |

| GENERAL INFORMATION ABOUT VOTING AND THE ANNUAL MEETING | 3 |

| PROPOSAL 1: ELECTION OF DIRECTORS | 8 |

8 | |

13 | |

13 | |

| Board Structure | 13 |

14 | |

| Meetings of the Board of Directors and Attendance | 14 |

14 | |

| Director Nomination Process and Qualifications | 18 |

| Corporate Governance Documents | 19 |

| Code of Business Conduct and Ethics | 19 |

19 | |

19 | |

| Director Compensation | 20 |

| PROPOSAL | 23 |

23 | |

23 | |

24 | |

24 | |

| Executive Officers | 25 |

| CERTAIN RELATIONSHIPS AND RELATED PERSON TRANSACTIONS | 27 |

27 | |

| Certain Related Person Transactions | 27 |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 29 |

| EQUITY COMPENSATION PLAN INFORMATION | 33 |

| NAMED EXECUTIVE OFFICER COMPENSATION | 34 |

34 | |

40 | |

| 41 | |

| 41 | |

| 42 | |

48 | |

| 54 | |

| CEO Pay Ratio | 57 |

| PROPOSAL | 58 |

| OTHER MATTERS | 59 |

60 | |

60 | |

60 | |

| Stockholder Proposals for the | 60 |

2 |2024 Coupang Proxy Statement |

Tower 730, 570, Songpa-daero, Songpa-gu, SeoulRepublic of Korea 05510

PROXY STATEMENT

For the 20222024 Annual Meeting of Stockholders

To Be Held on Thursday, June 16, 202213, 2024, at 5:00 p.m., Pacific Time

GENERAL INFORMATION ABOUT VOTING AND THE ANNUAL MEETING

This proxy statementProxy Statement (this “Proxy Statement”) is being furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”“Board”) of Coupang, Inc. (the “Company”“Company”, “Coupang”“Coupang”, “we”“we,” or “us”“us”) for use at the Company’s 2022our 2024 Annual Meeting of Stockholders (the “Annual Meeting”(including any adjournment or postponement thereof, the “Annual Meeting”). The Annual Meeting will be a completely virtual meeting, which will be conductedheld virtually via live webcast. To attend and vote at the Annual Meeting and view the list of registered stockholders as of the close of business on April 19, 2024 (the “Record Date”) during the meeting, stockholders of record must access the meeting website at www.virtualshareholdermeeting.com/CPNG2022CPNG2024 and enter the 16-digit control number found on the Internet Notice or on the proxy card provided to you with this proxy statement.Proxy Statement. If your shares are held in street name through a broker, bank, trustee, or other nominee and your Internet Notice or voting instruction form indicates that you may vote those shares through the www.proxyvote.com website, then you may access and vote at the Annual Meeting with the 16-digit control number indicated on that Internet Notice or voting instruction form. Otherwise, stockholders who hold their shares in street name should contact their broker bank, trustee, or other nominee that holds their shares (preferably at least five days before the Annual Meeting) to obtain a legal proxy in order to be able to attend, participate in, or vote at the Annual Meeting.

See “Attending the Virtual Meeting Online” below for more information.

Our fiscal year is consistent with the calendar year and ends on December 31. Unless stated otherwise, all references to years herein shall relate to our fiscal years. For example, references to year 2023 relate to our fiscal year ended December 31, 2023.

| Important Notice Regarding the Availability of Proxy Materials for the Annual Copies of this Proxy Statement and our Annual Report on Form 10-K for 2023 (the “2023 Annual Report”) are available at www.proxyvote.com. |

This proxy statement and our 2021 Annual Report on Form 10-K are available at www.proxyvote.com.

Voting Rights

Only holders of record of our Class A common stock and Class B common stock atas of the close of business on April 22, 2022 (the “Record Date”)Record Date will be entitled to vote at the Annual Meeting. You may vote all shares owned by you as of the Record Date, including (i) shares held directly in your name as the stockholder of record and (ii) shares held for you as the beneficial owner in street name through a broker, bank, trustee, or other nominee.

|

In deciding all matters at the Annual Meeting, as of the close of business on the Record Date, each share of Class A common stock represents one vote, and each share of Class B common stock represents 29 votes. We do not have cumulative voting rights for the election of directors. At the closeAs of business on the Record Date, we had 1,587,109,8501,612,466,408 shares of Class A common stock and174,802,990 shares of Class B common stock outstanding and entitled to vote, according to the records maintained by our transfer agent. At the close of business on March 31, 2022, our directors and executive officers and their respective affiliates were entitled to vote 115,777,400 shares of Class A common stock and 174,802,990 shares of Class B common stock at the Annual Meeting, or approximately 77.9% of the voting power of the shares of our Class A common stock and Class B common stock outstanding on such date.

For ten days prior to the Annual Meeting, a complete list of the stockholders entitled to vote at the Annual Meeting will be made available for examination by any stockholder for any purpose relating to the Annual Meeting during ordinary business hours at our headquarters, at Tower 730, 570, Songpa-daero, Songpa-gu, Seoul, Republic of Korea 05510,720 Olive Way, Suite 600, Seattle, Washington 98101, and will be available in electronic form on the day of the Annual Meeting at www.virtualshareholdermeeting.com/CPNG2022.CPNG2024. If, due to the COVID-19 pandemic,adverse weather conditions or other unforeseen circumstances, our headquarters are closed or visitation is limited during the ten days prior to the Annual Meeting, a stockholder may send a written request to corporatesecretary@coupang.com, and we will arrange a way for the stockholder to inspect the list.

| 3 | 2024 Coupang Proxy Statement |

Notice of Internet Availability of Proxy Materials

As permitted by the U.S. Securities and Exchange Commission (the “SEC”“SEC”) rules, Coupang is makingfor the Annual Meeting, we have elected to furnish our proxy materials, including this proxy statementProxy Statement and its 2021our 2023 Annual Report, available to itsour stockholders electronically via the Internet. On or about May 2, 2022,April 26, 2024, we mailed to our stockholders a Notice of Internet Availability of Proxy Materials (the “Internet Notice”(the “Internet Notice”) containing notice of the Annual Meeting and instructions on how to access our proxy materials, including this proxy statementProxy Statement and our 20212023 Annual Report, to vote at the Annual Meeting, and vote online.to request printed copies of the proxy materials. If you received an Internet Notice by mail, you will not receive a printed copy of the proxy materials in the mail unless you specifically request them. Instead, the Internet Notice instructs you on how to access and review all of the important information contained in the proxy statementthis Proxy Statement and 20212023 Annual Report. The Internet Notice also instructs you on how you may submit your proxy over the Internet. If you received an Internet Notice by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials contained on the Internet Notice. Stockholders may request to receive all future materials in printed form by mail or electronically by e-mail by following the instructions contained in the Internet Notice. We encourage stockholders to take advantage of the availability of the proxy materials on the Internet to help reduce the environmental impact and cost of our annual meetings.

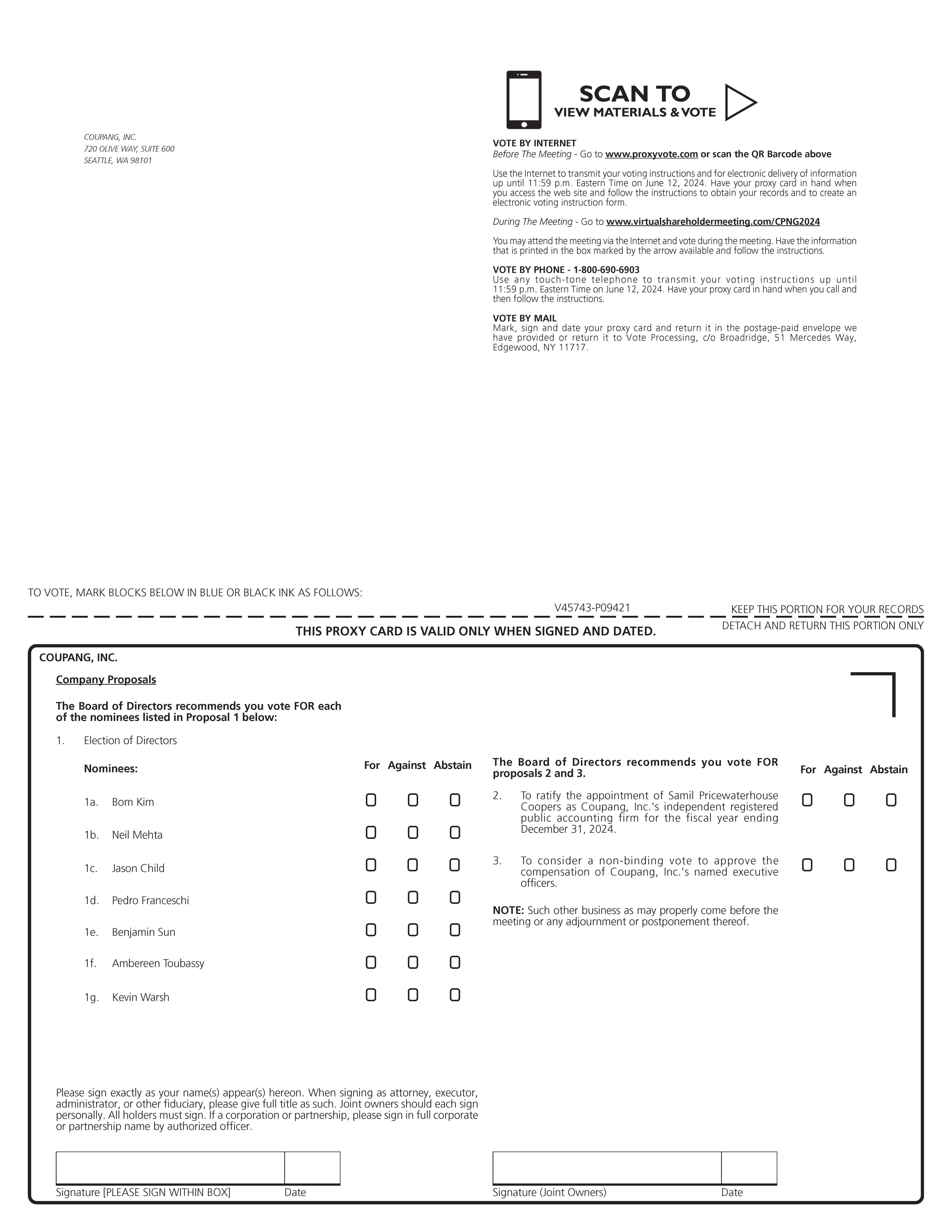

Printed Copies of Our Proxy Materials. If you received printed copies of our proxy materials, then instructions regarding how you can vote your shares are contained onin the proxy card included in those materials.

Voting Your Shares

If you are the record holder of your shares as of the close of business on the Record Date, you may vote in one of four ways. You may vote by submitting your proxy over the Internet, by telephone, or by mail, or you may vote electronically during the Annual Meeting.

|

| By Internet | ||||||

| You may vote your shares from any location in the world at www.proxyvote.com (you will need the control number printed on your Internet Notice or proxy | ||||||

| By Telephone | You may vote your shares by calling 1-800-690-6903 and following the instructions on your proxy card. | |||||

| By Mail | If you received a proxy card by mail, you may vote by completing, dating, and signing the proxy card and promptly mailing it in the postage-paid envelope provided. | |||||

| During the Meeting | To vote at the meeting, visit www.virtualshareholdermeeting.com/ |

| 4 | 2024 Coupang Proxy Statement |

Internet and telephone voting facilities for stockholders of record will be available 24 hours a day and will close at 8:59 p.m., Pacific Time, on June 15, 2022.12, 2024. Note that, in light of possible disruptions in mail service related to the COVID-19 pandemic,any unforeseen circumstances, we encourage stockholders to submit their proxy via telephone or online.

If the shares you own are held by a broker, bank, trustee, or other nominee in a fiduciary capacity (typically referred to as being held in “street name”), you may instruct that institution on how to vote your shares. You will receive instructions from the broker, bank, trustee, or other nominee that holds your shares, which you must follow in order for your shares to be voted.

Attending the Annual Meeting Online

We have determineddecided to hold the meeting by remote communicationAnnual Meeting virtually in the form of a live webcast. At this time, we believe that this is the right choice for Coupangthe Company and our stockholders as it provides expanded stockholder access regardless of the resources available to stockholders, improves communications, and givenreduces the ongoing pandemic, promotes the health and safetycarbon footprint of participants by allowing them to participate from any location at no additional cost.our activities. The Annual Meeting will convene promptly at 4:5:00 p.m., Pacific Time, on June 16, 2022.13, 2024. In order to attend and vote at the Annual Meeting, and view the list of registered stockholders as of the Record Date during the meeting, stockholders of record must access the meeting website at www.virtualshareholdermeeting.com/CPNG2022 CPNG2024 and input either the 16-digit control number found on the Internet Notice or on the proxy card provided to you with this proxy statement. If your shares are held in street name through a broker, bank, trustee, or other nominee and your Internet Notice or voting instruction form indicates that you may vote those shares through the www.proxyvote.com website, then you may access, participate in, and vote at the Annual Meeting with the 16-digit control number indicated on that Internet Notice or voting instruction form. Otherwise, stockholders who hold their shares in street name should contact their broker, bank, trustee, or other nominee that holds their shares (preferably at least five days before the Annual Meeting) to obtain a “legal proxy” in order to be able to attend, participate in, or vote at the Annual Meeting.

Even if you plan to attend the live webcast of the Annual Meeting, we encourage you to vote in advance by Internet, telephone, or mail so that your vote will be counted even if you later decide not to attend the Annual Meeting.

|

Technical Difficulties

We encourage you to access the Annual Meeting before it begins. Online check-in will be available at www.virtualshareholdermeeting.com/CPNG2022CPNG2024 approximately 15 minutes before the meeting starts on June 16, 2022.13, 2024. If you have difficulty accessing the meeting, please email ir@coupang.com.ir@coupang.com. We will have technicians available to assist you.

Recommendations of the Board

At the Annual Meeting, our stockholders will be asked to vote on the proposals set forth below. The Board recommends that you vote your shares as indicated below. If you return a properly completed proxy card or vote your shares by telephone

or over the Internet, your shares of common stock will be voted on your behalf as you direct. If not otherwise specified, the shares of common stock represented by the proxies will be voted in accordance with the Board’s recommendations as follows:

|  | “FOR” the election of the seven director nominees named |

| |

| “FOR” the ratification of the appointment of Samil PricewaterhouseCoopers as our independent registered public accounting firm for the fiscal year ending December 31, |

| |

| “FOR” the approval of the compensation of our named executive |

|

We are not aware of any matters to be voted on by stockholders at the Annual Meeting other than those referenced above. If any matter is properly presented at the Annual Meeting, your executed proxy gives your proxy holder discretionary authority to vote your shares in accordance with their best judgment with respect to the matter.

Broker Non-Votes

If the shares you own are held in street name through a broker, bank, trustee, or other nominee, thesuch broker, bank, trustee, or other nominee is required to vote your shares in accordance with your instructions. You should direct any such organization on how to vote the shares held in your account. Under applicable stock exchange rules, if you do not instruct the broker, bank, trustee, or other nominee that holds your shares on how to vote your shares, such organization will be able to vote your shares with respect to certain “routine” matters but will not be allowed to vote your shares with respect to certain “non-routine” matters. The ratification of the appointment of Samil PricewaterhouseCoopers as our independent registered public accounting firm is expected to be a routine matter. Each other proposal to be voted on at the Annual Meeting is expected to be a non-routine matter. Generally, broker non-votes occur when shares held by a broker, bank, trustee, or other nominee in street name for a beneficial owner are not voted with respect to a particular proposal because the organization has not received voting instructions from the beneficial owner and lacks discretionary voting power to vote those shares.

|

Note that whether a proposal is considered routine or non-routine is subject to stock exchange rules and final determination by the stock exchange. Even with respect to routine matters, some brokers are choosing not to exercise discretionary voting authority. As a result, we urge you to direct your broker, bank, trustee, or other nominee how to vote your shares on all proposals to ensure that your vote is counted.

Revoking Your Proxy or Changing Your Vote

Voting over the Internet or by telephone or execution of a proxy will not in any way affect a stockholder’s right to attend the Annual Meeting and vote electronically. A proxy may be revoked before it is used to cast a vote at the Annual Meeting. If you are the record holder of your shares, you can revoke a proxy by doing one of the following:

| ● | filing with our General Counsel and Chief Administrative Officer, at or before the taking of the vote at the Annual Meeting, a written notice of revocation bearing a later date than the proxy; |

| ● | properly submitting a duly executed proxy (via the Internet, telephone, or by returning a proxy card) bearing a later date; or |

| ● | attending the Annual Meeting and voting |

Any written notice of revocation should be sent to us at the following address: Coupang, Inc., C/O Coupang, Inc., Tower 730, 570, Songpa-daero, Songpa-gu, Seoul Republic of Korea 05510,720 Olive Way, Suite 600, Seattle, Washington 98101, Attention: Harold Rogers, General Counsel and Chief Administrative Officer.

If the shares you own are held in street name, you will need to follow the directions provided to you by your broker, bank, trustee, or other nominee that holds your shares to change your vote.

Quorum and Votes Required

The holders of a majority of the voting power of the outstanding shares of our Class A common stock and Class B common stock (voting together as a single class) entitled to vote at the Annual Meeting as of the Record Date must be present at the Annual Meeting in order to hold the Annual Meeting and conduct business. This presence is called a quorum. Your shares are counted as present at the Annual Meeting if you are present by remote communication at the Annual Meeting or if you have properly submitted a proxy. Abstentions and broker non-votes are included in the shares present or represented at the Annual Meeting for purposes of determining whether a quorum is present. If a quorum is not present, the chair of the Annual Meeting may adjourn the meeting until a quorum is obtained.

The table below sets forth the vote required for the approval of each proposal before the Annual Meeting, and the effect of abstentions and broker non-votes.

6 | 2024 Coupang |

| Proxy Statement |

| Proposal | Votes Required | Effect of Votes and Broker Non-Votes | ||

| Proposal 1 Election of Directors | ||||

| Each director is elected by the affirmative vote of the holders of a majority of the voting power of the outstanding shares of | Abstentions and broker non-votes will have the effect of a vote “Against.” | |||

| Proposal 2 Ratification of Appointment of Independent Registered Public Accounting Firm | The affirmative vote of the holders of a majority of the voting power of the shares present by remote communication or represented by proxy and entitled to vote thereon. | Abstentions will have the effect of a vote “Against.” We do not expect any broker non-votes on this proposal. | ||

| Proposal 3 Approval, on an Advisory (Non-Binding) Basis, of the Compensation of Our Named Executive Officers (“Say-on-Pay Vote”) | The affirmative vote of the holders of a majority of the voting power of the shares present by remote communication or represented by proxy and entitled to vote thereon. | Abstentions will have the effect of a vote “Against” and broker non-votes will have no effect. | ||

The votes will be counted, tabulated, and certified by a representative of Broadridge, the Company’sour inspector of election for the Annual Meeting. We plan to announce preliminary voting results at the Annual Meeting and we will report the final results in a Current Report on Form 8-K.

Solicitation of Proxies

The CompanyWe will bear the cost of soliciting proxies in the accompanying form and will reimburse brokerage firms and others for expenses involved in forwarding proxy materials to beneficial owners or soliciting their execution. In addition to solicitations by mail, the Company,we, through itsour directors and officers, may solicit proxies in person, by telephone, or by electronic means. Such directors and officers will not receive any special remuneration for these efforts.

|

PROPOSAL 1: ELECTION OF DIRECTORS

There are currently sevenThe nominating and corporate governance committee of the Board (the “Nominating and Corporate Governance Committee”) identifies, evaluates, and recommends nominees for directors to serve on the Board consistent with the criteria approved by the Board, including consideration of the potential conflicts of interest, director independence, diversity, and other relevant requirements. In doing so, our Nominating and Corporate Governance Committee seeks to assemble a board of directors that, as a group, can best perpetuate the success of the business and represent stockholder interests through the exercise of sound judgment using its diversity of background and experience in various areas. To that end, the committee has identified and evaluated nominees in the broader context of the Board’s overall composition, with the goal of recruiting members who complement and strengthen the skills of other members and who also exhibit integrity, collegiality, sound business judgment, and other qualities deemed critical to effective functioning of the Board. Upon the recommendation of the Nominating and Corporate Governance Committee, the Board has considered and nominated the seven incumbent directors listed below for electionre-election to the Board at the Annual Meeting.

The directors elected at the Annual Meeting will hold office until the 2023our annual meeting of stockholders to be held in 2025 after the end of our fiscal year ending December 31, 2024 (the “2025 Annual Meeting of Stockholders”) and until their successors are duly elected and qualified. We have no reason to believe that any of the nominees will be unavailable or, if elected, will decline to serve. In the event that these nominees should become unavailable for electionto serve due to any presently unforeseen reason, proxies will be voted for a substitute as designated by the Board, or alternatively, the Board may leave a vacancy on the Board or reduce the size of the Board.

Nominees for Election to the Board of Directors

OurThe Board of Directors

The biographies of each of our director nominees are included below. Each of the biographies highlights specific experience, qualifications, attributes, and skills that led us to conclude that such person should serve as a director.member of the Board. We believe that, as a whole, ourthe Board possesses the requisite skills and characteristics, leadership traits, work ethic, and independence to provide effective oversight. No director or executive officer is related by blood, marriage, or adoption to any other director or executive officer. No arrangements or understandings exist between any director and any other person pursuant to which such person was selected as a director or nominee.

Director Biographies

Bom Kim

Chief Executive Officer andChair of the Board

| 8 | 2024 Coupang Proxy Statement |

Bom Kim founded our company and has served as our Chief Executive Officer and as a member of our board of directors since May 2010. Mr. Kim attended Harvard University, earning an A.B. degree in Government.

Skills and Qualifications

We believe Mr. Kim is qualified to serve on our Board because of his extensive experience building and leading our business and his insight into our technology as our Founder and Chief Executive Officer.

|

Director Biographies

| Bom KimChief Executive Officer and Chair of the Board |

Age 45 Director Since2010 Committee MembershipsNone | |

Bom Kim founded our company and has served as our Chief Executive Officer and as a Chairman of the Board since May 2010. Mr. Kim attended Harvard University, earning an A.B. degree in Government. Skills and Qualifications We believe Mr. Kim is qualified to serve on the Board because of his extensive experience building and leading our business and his insight into our technology as our Founder and Chief Executive Officer. | |

Neil Mehta

Lead Independent Director

| Neil MehtaLead Independent Director |

Age 39 Director Since2010 Committee MembershipsCompensation (Chair); Nominating and Corporate Governance |

Neil Mehta has served as a member of our board since December 2010. Mr. Mehta founded Greenoaks Capital Partners LLC (“Greenoaks”), an investment firm, and has served as a Managing Director since April 2014. Prior to Greenoaks, Mr. Mehta was a Senior Investment Professional for special situations investments in India, the Middle East, and Southeast Asia for Orient Property Group Ltd., a Hong Kong-based investment firm financed by a fund managed by D.E. Shaw & Co., L.P., from October 2007 to November 2009. Mr. Mehta also previously worked for Kayne Anderson Capital Advisors, an alternative investment firm, where he invested in private companies in the general business and technology sector. Mr. Mehta earned a BSc in Government from The London School of Economics and Political Science.

Skills and Qualifications

We believe Mr. Mehta is qualified to serve as a member of our Board because of his operational experience in the technology industry and extensive knowledge of high-growth companies.

Jason Child

Jason Child has served as a member of our board since April 2022. Since 2019, Mr. Child has served as Senior Vice President and Chief Financial Officer of Splunk Inc., a data platform company for security and observability. Prior to joining Splunk, Mr. Child served as Chief Financial Officer at Opendoor Labs Inc., an online real estate marketplace, from 2017 to 2019. From 2015 to 2016, Mr. Child was Chief Financial Officer at AliphCom, Inc. (d/b/a Jawbone), a consumer technology and wearable products company. Mr. Child served as Chief Financial Officer at Groupon, Inc., an e-commerce company, from 2010 to 2015. Previously, he spent over 11 years leading various global finance teams at Amazon.com, Inc., an e-commerce and cloud computing company. Mr. Child began his career at Arthur Andersen LLP. He holds a B.A. from the University of Washington.

Skills and Qualifications

We believe Mr. Child is qualified to serve as a member of our Board because of his extensive background in finance and accounting matters.

Neil Mehta has served as a member of the Board since December 2010. Mr. Mehta founded Greenoaks Capital Partners LLC (“Greenoaks”), an investment firm, and has served as a Managing Director since April 2014. Prior to Greenoaks, Mr. Mehta was a Senior Investment Professional for special situations investments in India, the Middle East, and Southeast Asia for Orient Property Group Ltd., a Hong Kong-based investment firm financed by a fund managed by D.E. Shaw & Co., L.P., from October 2007 to November 2009. Mr. Mehta also previously worked for Kayne Anderson Capital Advisors, an alternative investment firm, where he invested in private companies in the general business and technology sector. Mr. Mehta earned a BSc in Government from The London School of Economics and Political Science. Skills and Qualifications We believe Mr. Mehta is qualified to serve as a member of the Board because of his operational experience in the technology industry and extensive knowledge of high-growth companies. | |

| 9 |2024 Coupang Proxy Statement |

Pedro Franceschi

| |

Jason Child

Pedro Franceschi has served as a member of our board since March 2022. Mr. Franceschi is Co-Founder & Co-CEO of Brex—a company reimagining financial systems for fast growing businesses. Launched in 2018 as the corporate card for startups, Brex now serves tens of thousands of companies through its expanded portfolio of financial services and software to help all fast-growing companies reach their full potential. Prior to launching Brex, Mr. Franceschi co-founded the payment company Pagar.me, a payment processor system, which was acquired by StoneCo Ltd., one of the largest payments companies in Brazil. At age 14, Mr. Franceschi built a popular window manager for Apple’s iPad allowing users to manage multiple applications simultaneously—a process previously impossible. At the age of 12, Mr. Franceschi was the first person to build software to make Apple’s Siri virtual assistant speak in Portuguese. Mr. Franceschi has served as a director of StoneCo Ltd. since May 2021.

Skills and Qualifications

We believe Mr. Franceschi is qualified to serve as a member of our Board because of his extensive experience creating and leading technology companies.

Benjamin Sun

Benjamin Sun has served on our board since July 2010. Mr. Sun is General Partner and co-founder of Primary Venture Partners, an early stage venture capital fund, since 2013. Mr. Sun also co-founded LaunchTime LLC (“LaunchTime”) in January 2010, which invests in early stage companies, and currently serves as a Partner. Previously, Mr. Sun served as President and Chief Executive Officer of Community Connect Inc., a leading online publisher, from October 1996 to December 2008 (Community Connect Inc. was acquired by Radio Once, Inc. in 2008). Mr. Sun began his financial career in Investment Banking at Merrill Lynch. Mr. Sun earned a B.A. degree in Economics from the University of Michigan in 1995.

Skills and Qualifications

We believe Mr. Sun is qualified to serve as a member of our Board because of his extensive experience working with technology companies.

Age 55 Director Since2022 Committee MembershipsAudit | |

Jason Child has served as a member of the Board since April 2022. Mr. Child has served as Executive Vice President and Chief Financial Officer of Arm Holdings plc, a technology company that provides processor designs and software platforms, since November 2022. Prior to joining Arm, Mr. Child served as Chief Financial Officer at various global companies, including as Senior Vice President and Chief Financial Officer of Splunk Inc., a technology company specializing in security and observability, from 2019 to 2022 and as Chief Financial Officer at Opendoor Technologies Inc., an online real estate company, from 2017 to 2019, as well as AliphCom, Inc. (d/b/a Jawbone), a consumer technology and wearable device company, and Groupon, Inc., a global e-commerce marketplace. He holds a B.A. from the Foster School of Business at the University of Washington, where he currently serves on its Global Advisory Board. Skills and Qualifications We believe Mr. Child is qualified to serve as a member of the Board because of his extensive background in global finance and strategy, accounting, capital markets and treasury, and investor relations matters, including his extensive experience in scaling disruptive technologies within enterprise software and software-as-a-service industries, e-commerce, and local commerce. | |

| Pedro Franceschi |

Age 27 Director Since2022 Committee MembershipsCompensation | |

Pedro Franceschi has served as a member of the Board since March 2022. Mr. Franceschi is Co-Founder & Co-Chief Executive Officer of Brex, a company reimagining financial systems for fast-growing businesses. Launched in 2018 as the corporate card for startups, Brex now serves tens of thousands of companies through its expanded portfolio of financial services and software to help all fast-growing companies reach their full potential. Prior to launching Brex, Mr. Franceschi co-founded the payment company Pagar.me, a payment processor system, which was acquired by StoneCo Ltd., one of the largest payments companies in Brazil. At age 14, Mr. Franceschi built a popular window manager for Apple’s iPad allowing users to manage multiple applications simultaneously-a process previously impossible. At the age of 12, Mr. Franceschi was the first person to build software to make Apple’s Siri virtual assistant speak in Portuguese. Mr. Franceschi has served as a director of StoneCo Ltd. since May 2021. Skills and Qualifications We believe Mr. Franceschi is qualified to serve as a member of the Board because of his extensive experience creating and leading technology companies. | |

| 10 | 2024 Coupang Proxy Statement |

Kevin Warsh

| Benjamin Sun |

Age 50 Director Committee MembershipsAudit, Compensation, Nominating and Corporate Governance | |

Benjamin Sun has served on the Board since July 2010. Mr. Sun has been General Partner and co-founder of Primary Venture Partners, an early-stage venture capital fund, since 2013. Mr. Sun also co-founded LaunchTime LLC (“LaunchTime”) in January 2010, which invests in early-stage companies, and currently serves as a Partner. Previously, Mr. Sun served as President and Chief Executive Officer of Community Connect Inc., a leading online publisher, from October 1996 to December 2008 (Community Connect Inc. was acquired by Radio Once, Inc. in 2008). Mr. Sun began his financial career in Investment Banking at Merrill Lynch. Mr. Sun earned a B.A. degree in Economics from the University of Michigan in 1995. Skills and Qualifications We believe Mr. Sun is qualified to serve as a member of the Board because of his extensive experience working with technology companies. | |

| Ambereen Toubassy |

Age 51 Director Since2023 Committee | |

Ambereen Toubassy has served as a member of the Board since March 2023. Ms. Toubassy has served as Chief Financial Officer of Airtable, a cloud-based software company, since January 2021. Prior to joining Airtable, Ms. Toubassy served as Chief Financial Officer of Quibi, a mobile media startup, from September 2018 to November 2020 and as Chief Financial Officer and Partner of WndrCo, a media and technology holding company, from May 2017 to September 2018. Her career spans multiple investing roles as partner and portfolio manager at JMB Capital, Ivory Capital Management, and Empyrean Capital Partners. Ms. Toubassy began her career at Goldman Sachs and worked in the Risk Arbitrage, M&A, and Software banking groups of Goldman Sachs. Ms. Toubassy holds a B.A. in Economics from Yale University and an MBA from Stanford University Graduate School of Business. Skills and Qualifications We believe Ms. Toubassy is qualified to serve as a member of the Board because of her extensive background in finance and accounting matters at technology companies. | |

| 11 | 2024 Coupang Proxy Statement |

| Kevin Warsh |

Age 54 Director Since2019 Committee MembershipsCompensation, Nominating and Corporate Governance (Chair) | |

Kevin Warsh has served as a member of our board since October 2019. Since April 2011, he has served as the Shepard Family Distinguished Visiting Fellow in Economics at the Hoover Institution and lecturer at the Stanford Graduate School of Business. He has served on the board of directors of United Parcel Service, a multinational package delivery and supply chain management company, since July 2012. Governor Warsh is a member of the Group of Thirty (“G30”) and the Panel of Economic Advisers of the Congressional Budget Office (“CBO”). Governor Warsh served as a member of the Board of Governors of the Federal Reserve System from 2006 until 2011. From 2002 until 2006, Governor Warsh served as Special Assistant to the President for Economic Policy and Executive Secretary of the White House National Economic Council. Previously, Governor Warsh was a member of the Mergers & Acquisitions department at Morgan Stanley & Co. in New York, serving as Vice President and Executive Director. Governor Warsh received his A.B. from Stanford University, and J.D. from Harvard Law School.

Skills and Qualifications

We believe Mr. Warsh is qualified to serve on our Board because of his extensive experience in economics, finance, and corporate governance.

Harry You

Harry You has served on our board since January 2021, and is Vice Chair of GTY Technology Holdings Inc., a leading SaaS provider to North American state and local governments as well as other public entities. Mr. You is Chair of dMY Technology Group VI, a public blank check company focused on mobile gaming and advanced technology (AI, cloud networking, and quantum computing). From 2008 to September 2016, Mr. You served as the Executive Vice President in the Office of the Chair of EMC Corporation. Mr. You joined EMC in 2008 to oversee corporate strategy and new business development, which included mergers and acquisitions, joint ventures, and venture capital activity. Mr. You was Chief Executive Officer of BearingPoint Inc. from 2005 to 2007 and also served as BearingPoint’s Interim Chief Financial Officer from 2005 to 2006. From 2004 to 2005, Mr. You served as Executive Vice President and Chief Financial Officer of Oracle Corporation, helping begin Oracle’s acquisition run with the takeovers of Peoplesoft, Inc. and Retek in 2005. From 2001 to 2004. Mr. You served as Chief Financial Officer of Accenture Ltd. in the first years after its IPO. Mr. You also previously spent 14 years in the financial services industry, including serving as a managing director in the Investment Banking Division of Morgan Stanley. Mr. You serves on the Audit and Compensation Committees of Broadcom Inc. Mr. You served on the board of directors of Korn/Ferry International, a global executive recruiting company, from 2004 to 2016, and has been a trustee of the U.S. Olympic Committee Foundation since 2016. Mr. You holds an M.A. in Economics from Yale University and a B.A. in Economics from Harvard College.

Skills and Qualifications

We believe Mr. You is qualified to serve as a member of our Board because of his financial and strategic planning expertise, public company financial management experience, cybersecurity experience, and executive leadership roles at various technology-driven companies, as well as his public company board and committee experience.

Kevin Warsh has served as a member of the Board since October 2019. Since April 2011, he has served as the Shepard Family Distinguished Visiting Fellow in Economics at the Hoover Institution and lecturer at the Stanford Graduate School of Business. He has served on the board of directors of United Parcel Service, a multinational package delivery and supply chain management company, since July 2012. Governor Warsh is a member of the Group of Thirty and the Panel of Economic Advisers of the Congressional Budget Office, and Governor Warsh advises Duquesne Family Office LLC. Governor Warsh served as a member of the Board of Governors of the Federal Reserve System from 2006 until 2011. From 2002 until 2006, Governor Warsh served as Special Assistant to the President for Economic Policy and Executive Secretary of the White House National Economic Council. Previously, Governor Warsh was a member of the Mergers & Acquisitions department at Morgan Stanley & Co. in New York, serving as Vice President and Executive Director. Governor Warsh received his A.B. from Stanford University, and J.D. from Harvard Law School. Skills and Qualifications We believe Mr. Warsh is qualified to serve on the Board because of his extensive experience in economics, finance, and corporate governance. | |

| 12 |2024 Coupang Proxy Statement |

The Board of Directors and Certain Governance Matters

Director Independence and Independence Determinations

Our Corporate Governance Guidelines (“Corporate Governance Guidelines”) provide that the Board will consist of a majority of independent directors. Under our Corporate Governance Guidelines and the rules and regulations of the New York Stock Exchange (the “NYSE rules,”), on which our Class A common stock is traded, a director is not independent unless the Board affirmatively determines that he or she does not have a direct or indirect material relationship with the Companyus or any of itsour subsidiaries. Our Corporate Governance Guidelines defineprovide that, to determine independence, the Board will consider the definition of independence in the applicable listing standards, which includes definition of an “independent” director in accordance with Section 303A.02 of the NYSE’s Listed Company Manual.Manual, and other factors that will contribute to effective oversight and decision making. In addition, members of the Audit Committee and Compensation Committee are subject to the additional independence requirements of applicable SEC rules and NYSE listing standards.

The Nominating and Corporate Governance Committee undertook its annual review of director independence and made a recommendation to ourthe Board regarding director independence. As a result of this review, ourthe Board affirmatively determined that Ms. Toubassy and Messrs. Child, Franceschi, Mehta, Sun, Warsh, and YouWarsh are independent for purposes of applicable NYSE standards, including with respect to any applicable committee service. In addition, the Board determined that each of Matthew Christensen and Lydia Jett, each of whomHarry You, who left the Board during 2021,in June 2023, was independent during the period in 2023 he or she served on the Board during 2021. OurBoard. In addition, the Board has determined that each of Ms. Toubassy and Messrs. Child Mehta,and Sun and You is “independent” for purposes of service on the Audit Committee in accordance with Section 10A(m)(3) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”“Exchange Act”), and that each of Messrs. Mehta, Franceschi, MehtaSun, and Warsh is “independent” for purposes of service on the Compensation Committee in accordance with Section 10C(a)(3) of the Exchange Act.

In assessing directors’ independence, the Board took into accountconsidered certain transactions, relationships, and arrangements involving some of the directors, including those described in the subsection titled “Certain Related Person Transactions” of this Proxy Statement, and concluded that such transactions, relationships, and arrangements, did not impair the independence of the director. For Mr. Mehta, the Board considered Mr. Mehta’s affiliation with Greenoaks, which beneficially owns 6.5% of Coupang’s Class A common stock as of March 31, 2022. For Ms. Jett, the Board considered Ms. Jett’s affiliation with SVF Investments (UK) Limited, which beneficially owns 29.1% of Coupang’s Class A common stock as of March 31,2022. Additionally, the Board considered that during 2021,2023, Mr. Child was employed by an organizationorganizations that did business with Coupang. The amount received by Coupang or such other organization in each of the last three fiscal years did not exceed the greater of $1 million or 1% of either Coupang’s or such organization’s consolidated gross revenues.

Board Structure

TheOur bylaws and Corporate Governance Guidelines provide that the Chair of the Board shall be appointed by the Board and that the positions of Chief Executive Officer and the Chair of the Board is selectedmay be held by the same person. Our Corporate Governance Guidelines further provide that in the event a non-independent director is serving as the Chair of the Board, and currently,the Board may designate a lead independent director, whose responsibilities shall include:

| ● | working with the Chief Executive Officer to develop Board meeting schedules and agendas; |

| ● | providing the Chief Executive Officer with feedback on the quality, quantity, and timeliness of the information provided to the Board; |

| ● | developing the agenda for and moderating executive sessions of the independent members of the Board; |

| ● | presiding over the Board meetings (when the Chair is not present); |

| ● | acting as principal liaison between the independent members of the Board and the Chief Executive Officer; |

| ● | convening meetings of the independent directors as appropriate; |

| ● | if requested and appropriate, being available for consultation with major stockholders; and |

| ● | performing such other duties as the Board may determine from time to time. |

| 13 | 2024 Coupang Proxy Statement |

Currently, Mr. Bom Kim, our founder and Chief Executive Officer, also holds both the Chair of the Board position, and CEO position. We believeMr. Neil Mehta has served as Lead Independent Director of the Board since our initial public offering (our “IPO”). The Board believes that the combined role of the Chair and CEOChief Executive Officer positions is appropriate and in the best interests of the Company and our stockholders, given Mr. Kim’s role in founding Coupang, the depth and breadth of his significant ownership stake. Theinsight into our business, vision, and industry. Further, the Board believes that this Board leadership structure is effective and improves the Board’s ability to focus on key policy and operational issues and helps the Companyus operate in the long-term interests of our stockholders.

Our Corporate Governance Guidelines provide that at any time that Executive Sessions

Mr. Kim, or anyone else who is not an independent director is serving as theChief Executive Officer and Chair of the Board, of Directors, the Board may designate a lead independent director.

The responsibilities of the lead independent director include:

|

Since our initial public offering, Neil Mehta has served as our lead independent director.

Mr. Kim, as Chair of the Board and CEO, is currently the only employee member of the Board. OurTo promote open discussion among the non-management directors, and as required under applicable NYSE rules and our Corporate Governance Guidelines, require that non-management directors of the Board meet inat regularly scheduled executive sessions (without members of management present) in accordance with NYSE listing standards. These executive sessions are chaired by, and Mr. Mehta, our lead independent director, Mr. Mehta.presides over all such executive sessions.

Meetings of the Board Meetingsof Directors and Attendance

Our Corporate Governance Guidelines provide that all directorsmembers of the Board are expected to prepare for, attend, and participate in all meetings of the Board and committees on which they serve. During 2021,2023, the Board met 5five times. No member of the Board attended fewer than 75% of the aggregate of the total number of meetings of the Board (held during the period for which he or she was a director) and the total number of meetings held by all committees of the Board on which such director served (held during the period that such director served), other than Mr. Mehta who attended 50%.

Members of Audit Committeethe Board are encouraged to attend annual meetings after his appointment to the committee in 2021.

The Company was not required to hold an annual meeting of stockholders in fiscal 2021 since none of our stock was publicly traded prior to March 2021. The Company doesstockholders; however, we do not have a formal policy with regard toregarding board members’ attendance at annual meetings of stockholders. Six of our directors then serving on the Board attended the 2023 Annual Meeting of Stockholders.

Committees of the Board Committees

OurThe Board has established three standing committees—committees thereof—the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee—each of which operates under a charter that has been approved by ourthe Board. Current copies of the Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee charters are posted on the “Corporate Governance”“Governance” section of the Investor Relations page of our website located at ir.aboutcoupang.com. Their.aboutcoupang.com. In 2023, the Audit Committee held 8eight meetings, the Compensation Committee held 3four meetings, and the Nominating and Corporate Governance Committee held 4 meetings in 2021.four meetings.

14 |2024 Coupang Proxy Statement |

AUDIT COMMITTEE

Primary Responsibilities

We have adopted a committee charter that details the primary responsibilities of the Audit Committee including:

Primary Responsibilities We have adopted a committee charter that details the primary responsibilities of the Audit Committee, including: ● | overseeing our accounting and financial reporting processes, systems of internal control, financial statement audits, and the integrity of |

● | evaluating and determining whether to retain the independent registered public accounting firm to audit our consolidated financial statements; |

● | assessing the qualifications, performance, and independence of the independent registered public accounting firm; |

● | reviewing the results of the audit with management and the independent registered public accounting firm, as well as our annual audited and quarterly financial statements, including management’s discussion and analysis of financial condition and results of operations and risk factors; |

● | overseeing procedures for receiving, retaining, and investigating complaints received by us regarding accounting, internal accounting controls, or auditing matters, and confidential and anonymous submissions by employees concerning questionable accounting or auditing matters; |

● | conferring with management and the independent registered public accounting firm concerning the scope, design, adequacy, and effectiveness of internal control over financial reporting and our disclosure controls and procedures; |

● | reviewing and approving related party transactions, in accordance with our policies; |

● | approving or, as permitted, pre-approving all audit and permissible non-audit related services and fees that the independent registered public accounting firm provide to us; and |

● | overseeing the activities of our internal audit function. Financial Expertise and Independence All members of the Audit Committee are “independent” in accordance with the NYSE listing standards and SEC rules applicable to boards of directors in general and audit committee members in particular. The Board has determined that Ms. Toubassy and Mr. Child each qualify as an “audit committee financial expert” as defined by the applicable SEC rules and that each member of the Audit Committee is “financially literate” within the meaning of the NYSE listing standards. Report The Report of the Audit Committee is set forth beginning on page 24 of this Proxy Statement. | Current Committee Members Jason Child (Chair) |

Financial Expertise and Independence

All members of the Audit Committee are “independent” in accordance with the NYSE listing standards and SEC rules applicable to boards of directors in general and audit committee members in particular. The Board has determined that Messrs. You and Child each qualify as an “audit committee financial expert” as defined by the applicable SEC rules and that each member of the Audit Committee is “financially literate” within the meaning of the NYSE listing standards.

Report

The Report of the Audit Committee is set forth beginning on page 23 of this proxy statement.

Current Committee Members

Harry You (CHAIR)

Neil Mehta

Jason Child

Benjamin Sun

15 | 2024 Coupang |

| Proxy Statement |

COMPENSATION COMMITTEE

Primary Responsibilities

We have adopted a committee charter that details the primary responsibilities of the Compensation Committee including:

Primary Responsibilities We have adopted a committee charter that details the primary responsibilities of the Compensation Committee, including: ● | reviewing, overseeing, and approving (or making recommendations to the Board for approval of) our overall executive compensation strategy and policies; |

● | reviewing and approving the compensation, individual and corporate performance goals and objectives, and other terms of employment of our executive officers; |

● | reviewing and approving (or making recommendations to the Board for approval of) the type and amount of compensation to be paid or awarded to Board members; |

● | reviewing our practices and policies of employee compensation as they relate to risk management and risk-taking incentives; |

● | administering our equity awards, pension, and profit sharing plans, bonus plans, benefit plans, and other similar programs; and |

● | periodically discussing with management and overseeing as it deems appropriate the development, implementation, and effectiveness of our policies and strategies relating to our human capital management function, including but not limited to those policies and strategies regarding recruiting, retention, career development and progression, diversity and inclusion, and employment practices. |

Independence

All members of the Compensation Committee are “independent” in accordance with NYSE listing standards and SEC rules applicable to boards of directors in general and compensation committees in particular. In addition, all members of the Compensation Committee qualify as “non-employee directors” for purposes of Rule 16b-3 under the Exchange Act.

Delegation Authority

The Compensation Committee may form and delegate authority to subcommittees for any purpose that the Committee deems appropriate, including (a) a subcommittee consisting of a single member, and (b) a subcommittee consisting of at least two members, each of whom qualifies as non-employee directors under Section 16 of the Exchange Act.

Role of Executive Officers and Compensation Consultant

See page 32

Independence

All members of the Compensation Committee are “independent” in accordance with NYSE listing standards and SEC rules applicable to boards of directors in general and compensation committees in particular. In addition, each of Messrs. Franceschi and Sun qualify as “non-employee directors” for purposes of Rule 16b-3 under the Exchange Act.

Delegation Authority

Under the charter of the Compensation Committee, the Compensation Committee may form and delegate authority to one or more subcommittees, consisting of one or more members of the Board (whether or not he, she, or they are on the Compensation Committee) for any purpose that the Committee deems appropriate, including (a) a subcommittee consisting of a single member, and (b) a subcommittee consisting of at least two members, each of whom qualifies as a “non-employee director” for purposes of Rule 16b-3 under the Exchange Act. Pursuant to this delegation authority, the Compensation Committee has formed a subcommittee thereof, named “Section 16 Equity Committee,” for the purpose of granting equity awards under our compensation plans in accordance with Rule 16b-3 under the Exchange Act, consisting of Messrs. Franceschi and Sun, each of whom qualifies as a “non-employee director” for purposes of Rule 16b-3 under the Exchange Act.

Compensation Committee Interlocks and Insider Participation

None of the directors who are currently or who were members of our Compensation Committee during 2023 are either currently, or have been at any time, one of our officers or employees. None of our executive officers currently serves, or served during 2023, as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of our Board or Compensation Committee. See the section titled "Certain Relationships and Related Person Transactions" for information about related party transactions involving members of our Compensation Committee or their affiliates.

Role of Executive Officers and Compensation Consultant

See page 34 of this Proxy Statement for a discussion of the role of our executive officers and compensation consultant in determining executive compensation.

Current Committee Members

Neil Mehta (CHAIR)

Pedro Franceschi

Kevin Warsh

Report The Report of the Compensation Committee is set forth beginning on page 41 of this Proxy Statement. | Current Committee Members Neil Mehta (Chair) | |

| 16 | 2024 Coupang Proxy Statement |

NOMINATING AND CORPORATE GOVERNANCE COMMITTEE

Primary Responsibilities

We have adopted a committee charter that details the primary responsibilities of the Nominating and Corporate Governance Committee including:

Primary Responsibilities We have adopted a committee charter that details the primary responsibilities of the Nominating and Corporate Governance Committee, including: ● | helping the Board oversee |

functions;

● | advising |

matters;

● | identifying and evaluating candidates, including the nomination of incumbent directors for reelection and nominees recommended by stockholders, to serve on the |

Board;

● | considering and making recommendations to |

Board;

● | reviewing and making recommendations to the Board regarding our corporate governance guidelines and related policies and |

procedures;

● | periodically reviewing the performance of the Board, including Board |

● | periodically reviewing the processes and procedures used by us to provide information to the Board and its committees. Independence All members of the Nominating and Corporate Governance Committee are “independent” in accordance with NYSE listing standards. | Current Committee Members Kevin Warsh (Chair) |

Independence

All members of the Nominating and Corporate Governance Committee are “independent” in accordance with NYSE listing standards.

| 17 | 2024 Coupang Proxy Statement |

Current Committee Members

Kevin Warsh (CHAIR)

Harry You

Neil Mehta

Director Nomination Process and Qualifications

We believe that an effective board should be made up of individuals who collectively provide an appropriate balance of diverse occupationalprofessional and personal backgrounds and perspectives and who have a range of skills and expertise sufficient to provide guidance and oversight with respect to the Company’sour strategy and operations. The Board and the Nominating and Corporate Governance Committee seek individuals with backgrounds and qualities that, when combined with those of our other directors, enhance the Board’s effectiveness and result in the Board having a balance of knowledge, experience, and capability.

In assessing potential candidates, the Board and the Nominating and Corporate Governance Committee will consider, among other factors, whether the candidate:

| ● | possesses relevant expertise to offer advice and guidance to management; |

| ● | has sufficient time to devote to the affairs of the Company; |

|

| ● | demonstrates excellence in his or her field; |

| ● | has the ability to exercise sound business judgment; and |

| ● | is committed to represent the long-term interests of |

Moreover, the Board and the Nominating and Corporate Governance Committee will carefully consider the importance to the Company of diversity, broadly defined, in the board composition (including diversity of gender, experience, ethnic background, and, country of origin) and, inwhen assessing potential candidates, will take into account a candidate’s diversity and status as a member of an underrepresented community. The Board will assess its effectiveness in this regard as part of the annual board evaluation process.

In addition, our Corporate Governance Guidelines also require that to be qualified to serve as a director, a candidate must possess the highest personal integrity and ethics, havepossess the ability to read and understand basic financial statements, and be older than 21 years of age.

The Nominating and Corporate Governance Committee considers the appropriate size of the Board and whether any vacancies on the Board are expected due to retirement or otherwise. In the event that vacancies are anticipated, or otherwise arise, or the Nominating and Corporate Governance Committee and the Board determine to increase the size of the Board, the Nominating and Corporate Governance Committee considers potential director candidates using the criteria set forth above. Candidates may come to the attention of the Nominating and Corporate Governance Committee through current Board members, members of management, professional search firms, stockholders, or other persons. The Nominating and Corporate Governance Committee is responsible for conducting appropriate inquiries into the backgrounds and qualifications of potential director candidates and evaluating their suitability for service on ourthe Board.

In the case of Mr. Franceschi, the Board, upon the recommendation of the Nominating and Corporate Governance Committee, approved him as a director nominee in recognition of his extensive experience creating and leading technology companies. With respect to Mr. Child, the Board, upon the recommendation of the Nominating and Corporate Governance Committee, approved him as a director nominee in recognition of his extensive background in finance and accounting matters. Mr. Franceschi was identified as a potential director nominee by an independent member of our Board of Directors and Mr. Child was identified as a potential director nominee by a third-party search firm and a member of management.

The Nominating and Corporate Governance Committee will evaluate director candidates recommended by stockholders in the same manner in which the Nominating and Corporate Governance Committee evaluates any other director candidate.

Any recommendation submitted to the General Counsel and Chief Administrative Officer should be in writing and should include any supporting material the stockholder considers appropriate in support of that recommendation but must include information that would be required under the “advance notice” provisions of the Company’sour bylaws and rules of the SEC to be included in a proxy statement soliciting proxies for the election of such candidate. Stockholders wishing to propose a candidate for consideration may do so by submitting the above information to the attention of the General Counsel and Chief Administrative Officer of the Company at c/o Coupang, Inc., Tower 730, 570, Songpa-daero, Songpa-gu, Seoul Republic of Korea 05510.720 Olive Way, Suite 600, Seattle, Washington 98101, U.S.A. All recommendations for nomination received by the General Counsel and Chief Administrative Officer that satisfy our “advance notice” bylaw requirements relating to such director nominations will be presented to the Board for its consideration. Stockholders must also satisfy the notification, timeliness, consent, and information requirements set forth in our bylaws. These requirements are also described under the section entitled “Stockholder Proposals for the 20232025 Annual Meeting of Stockholders”.Stockholders.”

18 |2024 Coupang Proxy Statement |

Corporate Governance Documents

Complete copies of our Corporate Governance Guidelines and committeeCommittee charters are available on the Investor Relations page of our website at ir.aboutcoupang.com.ir.aboutcoupang.com.

Code of Business Conduct and Ethics

Our Code of Business Conduct and Ethics is available on the Investor Relations page of our website at www.ir.aboutcoupang. com.ir.aboutcoupang.com. If the Companywe ever were to amend or waive any provision of itsour Code of Business Conduct and Ethics that applies to the Company’sour executive officers or directors, the Company intendswe intend to satisfy itsour disclosure obligations, if any, with respect to any such waiver or amendment by posting such information on itsour website set forth above rather than by filing a Current Report on Form 8-K.

Communications with the Board

Stockholders and other interested parties may communicate with a member or members of ourthe Board, including the Chair of the Board, Chair of the Audit, Compensation, or Nominating and Corporate Governance Committees, or to the non-management or independent directors. We maintain a “Stockholders Communications Policy” that outlines the applicable procedures and is available on the Investor Relations page of our website at www.ir.aboutcoupang.com.ir.aboutcoupang.com.

Board’s Role in Risk Oversight

OurThe Board’s role in risk oversight at the Company is consistent with the Company’sour leadership structure, with the CEOChief Executive Officer and other members of senior management having responsibility for assessing and managing risks faced by the Companywe face in executing itsour business plans, and ourthe Board and its committees providing oversight in connection with those efforts. These risks include, but are not limited to, financial, legal and regulatory, technological, competitive, and operational risks and exposures.

In addition to the full Board, the Audit Committee plays an important role in the oversight of the Company’sour enterprise risk assessment and management activities, which identify key risks to the Company’sour business, including risks related to cybersecurity,financial reporting, information security, data privacy, and other regulations, and assesses any steps taken to monitor and control such risk. The Audit Committee periodically reviews key enterprise risks with senior management and the Head of Internal Audit.Chief Audit Executive.

The Compensation Committee is charged with ensuring thatoverseeing risks relating to human capital and assessing whether our compensation policies and procedures do not encourage risk-taking in a manner that would have a material adverse impact on the Company.us.

The Nominating and Corporate Governance Committee is charged with overseeing risk related to our governance processes. Each Committee reports its findings to the full Board for consideration.

| 19 | 2024 Coupang Proxy Statement |

|

Director Compensation

In December 2021, ourthe Board adopted a director compensation policy for our non-employee directors. Fordirectors and subsequently amended the portion of 2021 prior topolicy in June 2023 (as so amended, the adoption of such director compensation policy, we compensated our non-employee directors in accordance with practices established by our“Non-Employee Director Compensation Policy”). The Board and, following our initial public offering, ourhas formed the Compensation Committee into oversee, with consultation with ourthe Board and compensation consultants. In accordance with such practices, upon joiningconsultants, the Board in January 2021, Harry You received an award of 207,560 restricted equity units (“REUs”), which are scheduled to vest at the rate of 20% per year on each of the first five anniversaries of his commencement of service as a non-employee director, subject to continued service through each vesting date. In connection with our initial public offering, these REUs converted into restricted stock units (“RSUs”) covering 207,560 shares of our Class A common stock, which continue to be subject to the same vesting conditions. Additionally, Lydia Jett, who left the Board in October 2021, received, in March 2021, an award of RSUs covering 8,571 shares of our Class A common stock, which were scheduled to vest in March 2022. These RSUs did not vest and were instead forfeited upon Ms. Jett’s departure from the Board. During 2021, Matthew Christensen, Neil Mehta, Benjamin Sun, and Kevin Warsh did not receive any compensation for their service as directors.Non-Employee Director Compensation Policy.

Under the director compensation policy adopted in December 2021, each non-employee director will receive the equity compensation for Board services described below. We also will reimburse our non-employee directors for reasonable travel, lodging, and meal expenses incident to meetings of the Board or Committees thereof or in connection with other Board- related business.

The director compensation policy includes a maximum annual limit of $750,000 of cash compensation and equity awards that may be paid, issued, or granted to a non-employee director in any calendar year other than in the non-employee director’s first calendar year of service, in which case the maximum is $1,000,000. The maximum limit does not reflect the intended size of any potential compensation or equity awards to our non-employee directors.

Initial Equity Award: Awards

In connection with joining the Board, a new non-employee director may be granted an equity award in the form of RSUs coveringrestricted stock units, with each such unit representing a numbercontingent right to receive one share of shares of ourthe Company’s Class A common stock havingCommon Stock upon settlement (“RSUs”), with a maximum aggregate value of up to $1,000,000 (as determined by the Board) on the date of grant,, based on the closing price of our Class A common stock on the date of grant. Each initial award will vest on a schedule determined by the Board at the time of grant. If a non-employee director resigns from the Board prior to the vesting date, the unvested portion of any initial award will be forfeited as of the date of resignation. In the event of a “change of control” (as defined in our 2021 Equity Incentive Plan), the unvested portion of any initial award will vest in full.

Annual Equity Award: Awards

On the date of each annual meeting of stockholders, each non-employee director who is serving on ourthe Board, who has no outstanding and unvested stock grant, and will continue to serve on ourthe Board as a non-employee director immediately following the date of such annual meeting, will automatically be granted an equity award in the form of RSUs covering athe number of shares of our Class A common stock having a value of $300,000, based on the closing price of our Class A common stock on the date of grant.

Additionally, each non-employee director will be eligible to earn additional annual retainers for their additional services as follows, in each case in the form of RSUs covering athe number of shares of our Class A common stock having the value set forth below (based on the closing price of our Class A common stock on the date of grant):

| ● | $25,000 for service as Lead Independent Director; |

| ● | $25,000 for service as chair, or $12,500 for service as a member (other than as chair), of our Audit Committee; |

|

| ● | $20,000 for service as chair, or $10,000 for service as a member (other than as chair), of our Compensation Committee; and |

| ● | $15,000 for service as chair, or $7,500 for service as a member (other than as chair), of our Nominating and Corporate Governance Committee. |

Each annual equity award granted, including awards granted for additional services described above, will be scheduled to vest in full on the earlier of the first anniversary of the date of grant or the date of the next annual meeting of stockholders following the date of grant.

If a non-employee director terminates service in aany Board leadership or Committee role prior to the vesting date of their annual award but otherwise remains as a member of the Board, any applicable lead independent director retainer or Committee retainer will vest, unless a different vest date is provided for by the Board, on a pro-rata basis taking account ofto reflect the applicable non-employee director’s length of Board leadership or Committee service, as applicable, during the vesting period. If an incumbent non-employee director is appointed to any new Board leadership or Committee position during his or her tenure on the Board, such non-employee director will be granted an award of RSUs for such new Board leadership or Committee service. The grant date for such partial year committee award will be the date that the non-employee director’s appointment to the applicable Board leadership or Committee position is effective, unless otherwise provided by the Board. The aggregate dollar value of the partial year committee award will be based on the annual retainers set forth above but prorated to reflect the length of service in such new role. Each partial year committee award granted will vest in full on the first annual award vest date to occur after the applicable grant date, subject to the non-employee director’s continued service to the Company through the applicable annual award vest date. Except as otherwise provided by the Board or in any related award agreement or other written agreement between a non-employee director resigns fromand the Board priorCompany, all equity awards granted under the Non-Employee Director Compensation Policy are subject to the vesting date, all unvested annual equity awards, including awards granted for additional services described above, will be forfeited as ofnon-employee director’s continued service to the date of resignation.Company through the applicable vest date. In the event of a “change of control”“Change in Control” (as defined in our 2021 Equity Incentive Plan), all unvested annual equity awards under the Non-Employee Director Compensation Policy, including awards granted for additional services described above, that remain unvested at the time of such Change in Control will vest in full.

| 20 | 2024 Coupang Proxy Statement |

Additionally, under

Limitation on Non-Employee Director Compensation

The Non-Employee Director Compensation Policy includes a maximum annual limit of $750,000 of cash compensation and equity awards that may be paid, issued, or granted to a non-employee director in any calendar year other than in the director compensation policy,non-employee director’s first calendar year of service, in which case the maximum is $1,000,000.

Expense Reimbursement

Under the Non-Employee Director Compensation Policy, each non-employee director who held unvested RSUs asis entitled to reimbursement from us for reasonable travel, lodging, and meal expenses incident to meetings of the date the director compensation policy was adoptedBoard or committees thereof or in December 2021 will not be eligible to receive an annual equity award until the date of the first annual meeting of stockholders that occurs after such outstanding RSUs have become fully vestedconnection with other Board-related business, in accordance with their terms.and subject to our expense reimbursement policy as presented to the Audit Committee of the Board.

| 21 | 2024 Coupang Proxy Statement |

Director Compensation Table

The following table provides information regarding compensation of our non-employee directors for their service as a director for the fiscal year ended December 31, 2021.2023. Employee directors received no additional compensation for their service as a director.

| Name | Stock Awards(1) | Total | |

| Matthew Christensen | — | — | |

| Lydia Jett | $432,407(2) | $432,407 | |

| Neil Mehta | — | — | |

| Benjamin Sun | — | — | |

| Kevin Warsh | — | — | |

| Harry You | $2,420,150 | $2,420,150 |

| Name | Stock Awards(1) | Total | ||

| Jason Child | $324,992 | $324,992 | ||

| Pedro Franceschi | $309,991 | $309,991 | ||

| Neil Mehta | $352,484 | $352,484 | ||

| Benjamin Sun | $319,986 | $319,986 | ||

| Ambereen Toubassy(2) | $398,090 | $398,090 | ||

| Kevin Warsh | $324,992 | $324,992 | ||

| Harry You(3) | — | — |

| 1. | Amounts in this column represent the aggregate grant date fair value of RSUs granted during | |

| 2. | Ms. Toubassy was appointed to the Board on March 8, 2023 and received an initial equity award upon such appointment with a grant date fair value of $85,604, in addition to her annual equity award for 2023 with a grant date fair value of $312,486. | |

| 3. | Mr. |

22 | 2024 Coupang |

| Proxy Statement |

PROPOSAL 2: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Appointment of Independent Registered Public Accounting Firm

The Audit Committee is solely responsible for the appointment, evaluation, compensation, retention, and, if appropriate, replacement of the independent registered public accounting firm retained to audit the Company’sour financial statements. The Audit Committee has selected Samil PricewaterhouseCoopers to serve as our independent registered public accounting firm for 2022.our fiscal year ending December 31, 2024. Samil PricewaterhouseCoopers has served as the Company’sour auditor since 2014.